do nonprofits pay taxes on utilities

Yes nonprofits must pay federal and state payroll taxes. However this corporate status does not automatically grant exemption from federal income tax.

Pdf Two Sides Of The Same Coin An Investigation Of The Effects Of Frames On Tax Compliance And Charitable Giving

However some states allow certain types of nonprofit organizations a special exemption from sales tax.

. 1 Most nonprofits have paid staff. Determining when to include rental income in your unrelated business income UBI tax calculation can be challenging. To be tax exempt most organizations must apply for recognition of exemption from the Internal Revenue Service to obtain a ruling or.

Your recognition as a 501 c 3 organization exempts you from federal income tax. After being recognized as a tax-exempt nonprofit organization by the IRS a nonprofit is exempt from paying taxes on revenues generated in support of the. Do nonprofits pay payroll taxes.

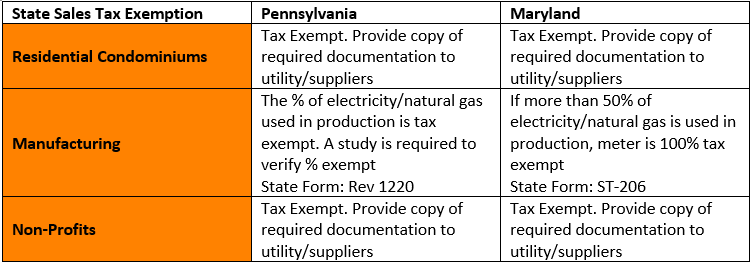

Hospitals and other nonprofit organizations are exempt from state sales tax on regulated electric natural gas and telecommunication bills. Do nonprofits pay federal taxes. We pay a bunch in payroll taxes just like for-profits.

This depends on whether the nonprofit is a recognized 501c3 organization. Even though the federal government awards federal tax-exempt status a state can require additional documentation to honor it. What Has Changed Previously nonprofit organizations that qualify as IRS 501 c 3 organizations were exempt from collecting New York sales tax in many situations.

But nonprofits still have to pay employment taxes on behalf of their employees and withhold payroll taxes in accordance with the information submitted on their W4 just like any other employer. Non-profits dont pay taxes unless they have unrelated business income. It is important to contact each utility in order to.

In most states 501 c 3 entities must pay sales tax on their purchases and charge sales tax on the items they sell. A nonprofit that identifies as a 501. In most states nonprofits are also responsible for paying the sales tax or using a tax on their purchases and charging the sales tax on their sold items.

If the nonprofit has paid staff the organization must cover the employers portion of their Social Security Medicare and unemployment taxes. However the rules vary slightly between a nonprofit and a. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses are responsible for.

The short answer is yes. While most states wont require nonprofit organizations to pay the state income tax some have specific fees or special requirements to prove your tax-exempt status. However they arent completely free of tax liability.

Effective September 1 2008 they must collect state and local sales. We created a beginners guide checklist to help you get started. The exemption is generally limited to the purchase of items used in their exempt purpose.

However it is a commonly conducted non-profit organization activity. It is true that in 2015 US. And most of us pay sales taxes for all the supplies and stuff we use to do our work.

While nonprofits typically will not have to pay taxes they still have to submit annual tax returns with the IRS. 4 but neither of these organizations receive donations and thus. There often is a misperception that we dont pay sales tax when we purchase all the supplies and equipment that we need to operate our.

Nonprofit organizations benefited from somewhere in the neighborhood of 137 billion in tax preferences from exemptions and deductionsbut at the same time they sent approximately 243 billion to various government entities in the form of taxes tax withholding for others and fees. 1 for instance your local chamber of commerce probably is a 501 c 6 which is tax-exempt. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

However there are special exemptions and exclusions available for certain nonprofit and religious organizations. Being tax exempt means an organization doesnt pay federal taxes but they still have to provide the IRS with the information they need. The Jamestown North Dakota City Council is considering a new stormwater fee to be applied to all properties including property owned by nonprofits churches parks and governments.

This results in significant savings on monthly utility bills. The research to determine whether or not sales tax is due lies with the nonprofit. Although even the tax-exempt entities will have to pay certain federal payroll taxes.

The City itself would be expected to pay 3150 per month under the proposed plan. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the nonprofit corporations tax-exempt purposes. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

In some cases nonprofits that are exempt from property taxes may also be exempt from municipal and county fees such as those for water and sewer. Generally a nonprofits sales and purchases are taxable. Those states that provide a sales tax exemption.

Some nonprofits those designated 501 c in the tax code enjoy the first exemption but not the second one. Nonprofits already pay all sorts of taxes. 3 your recreational club might be a 501 c 7 which is also tax-exempt.

If the organization grosses less than 50k per year they have a simple online postcard filing called a 990-N that is due on 4 12 months after the end of their fiscal year. In short the answer is both yes and no. There are some instances when nonprofits and churches are still required to pay taxes.

Depending on the amount of work a. This is true for any nonprofit no matter their status. There are two common types of rental income we see among our non-profit clients.

In other words California generally treats nonprofit and religious organizations just like other sellers and buyers when it comes to sales and use tax purposes. Any nonprofit that hires employees will also need to pay employee taxes like Social Security Medicare and in some cases Unemployment Taxes.

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

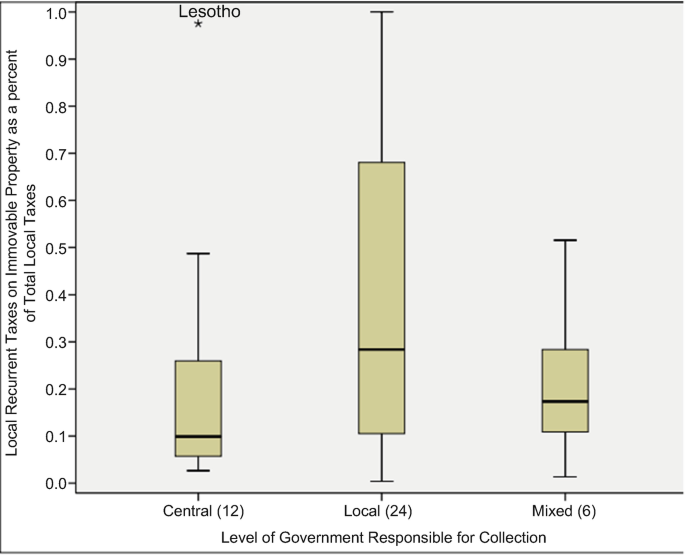

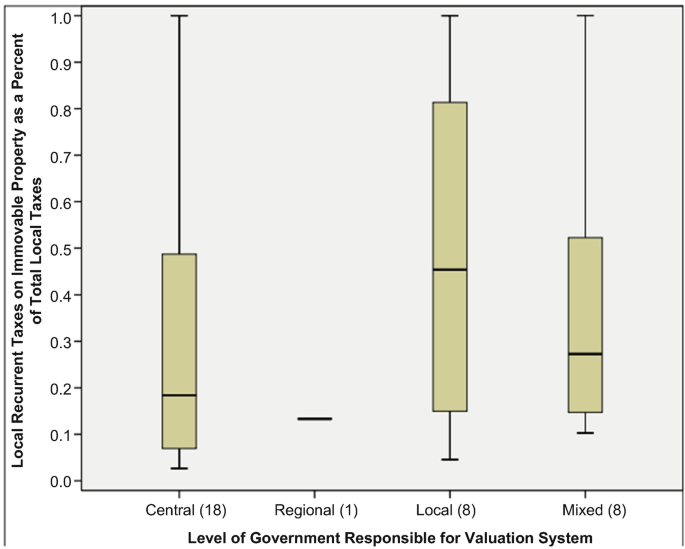

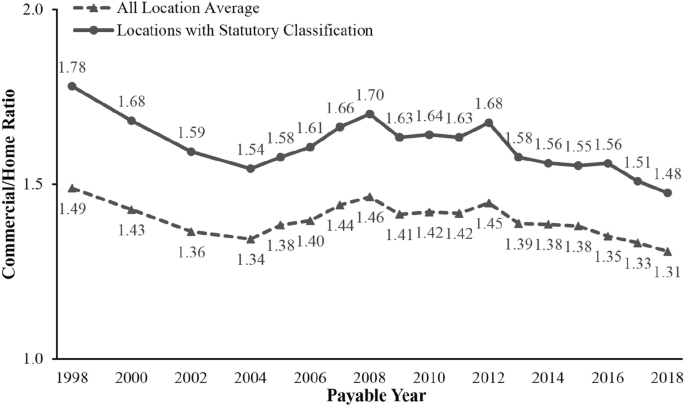

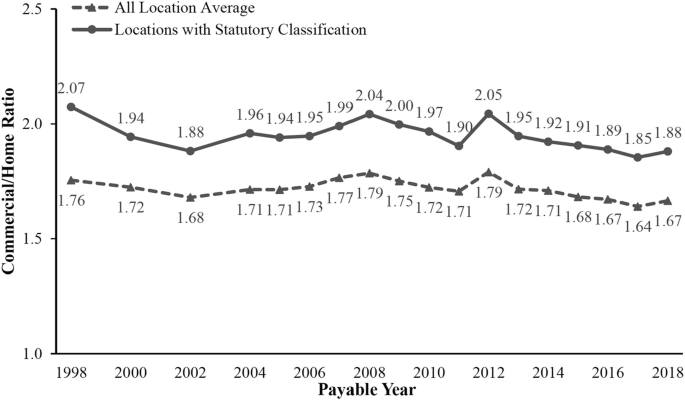

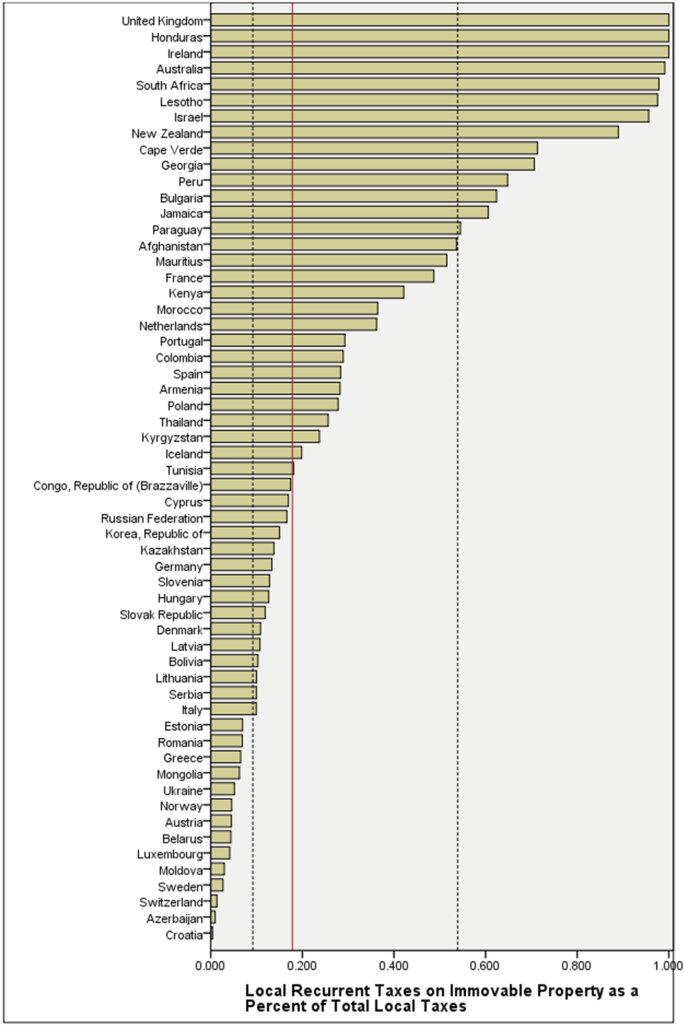

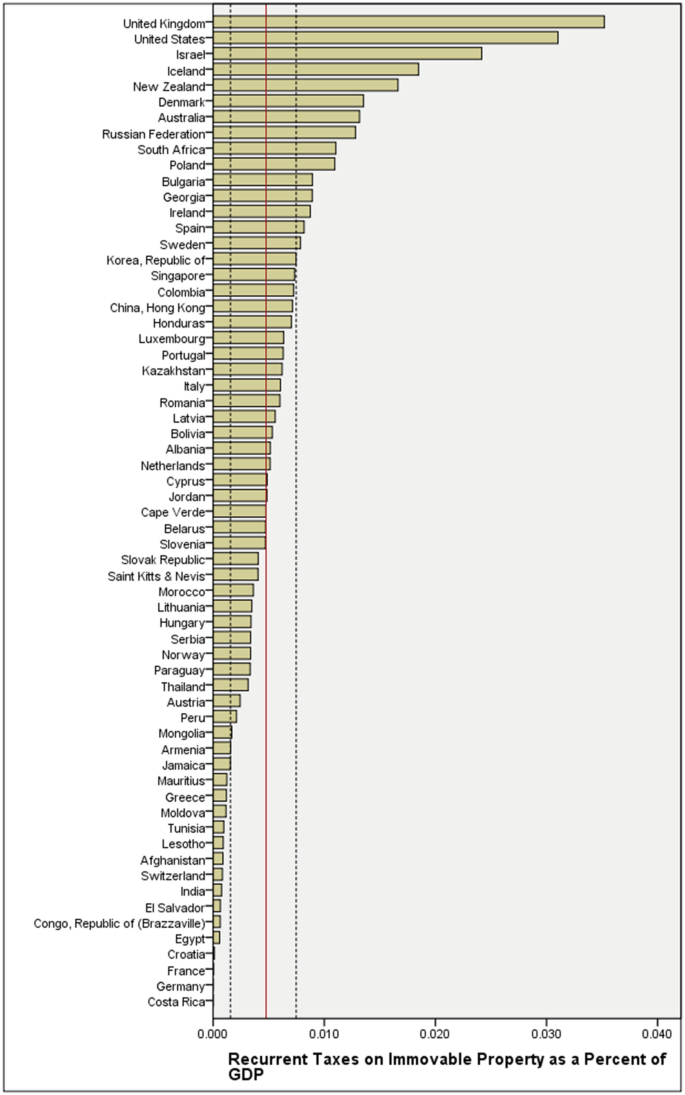

The Practice Of Real Property Taxation In The World Springerlink

Why Do We Pay Government Taxes And Also Pay For Electricity Bill Is Electricity Not Suppose To Be Free After Tax Quora

The Practice Of Real Property Taxation In The World Springerlink

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Checklist Template

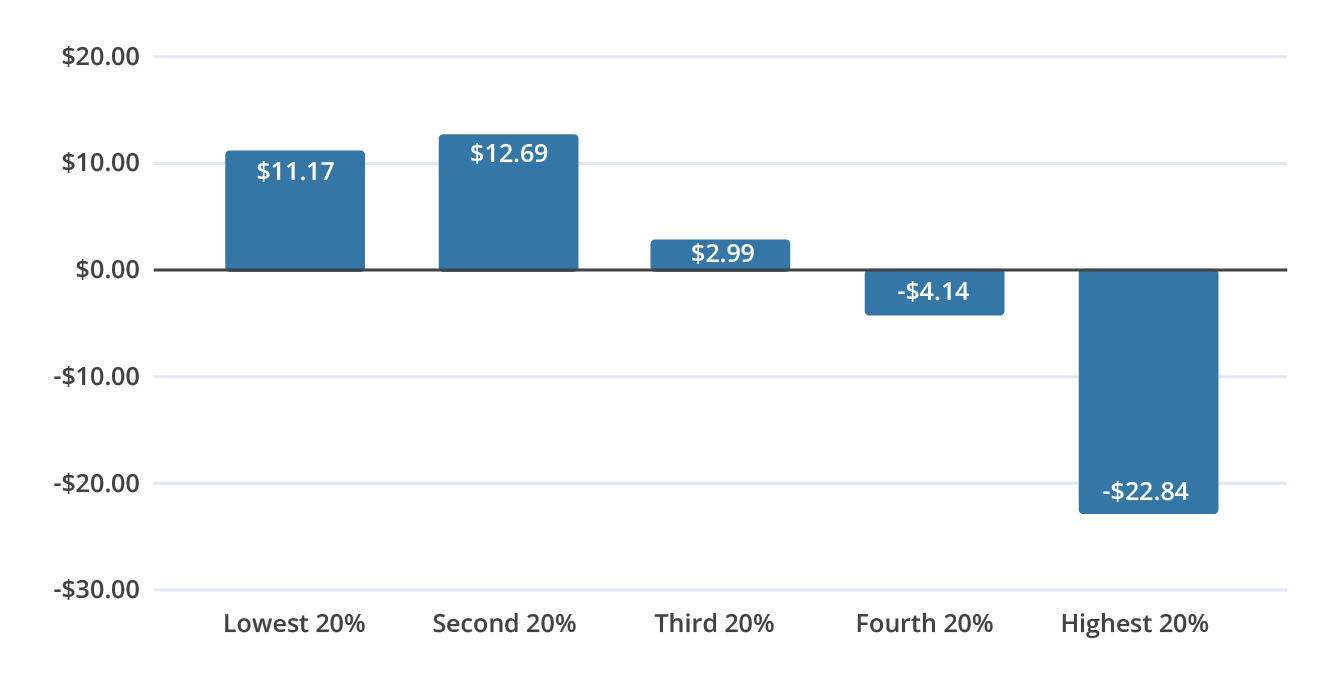

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

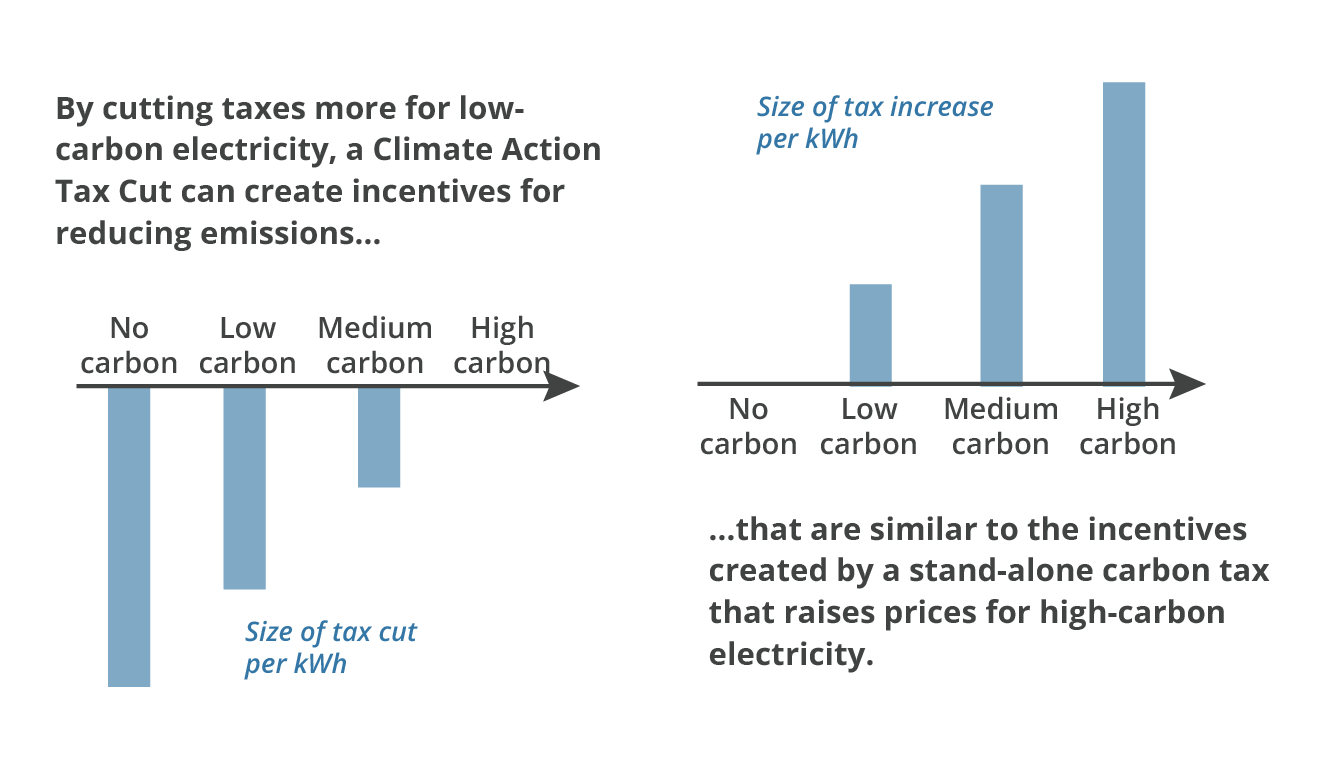

Carbon Taxes Without Tears The Cgo

The Practice Of Real Property Taxation In The World Springerlink

Carbon Taxes Without Tears The Cgo

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Smartsheet

The Practice Of Real Property Taxation In The World Springerlink

Do You Think Churches Should Be Taxed Quora

The Practice Of Real Property Taxation In The World Springerlink

Tax Exemptions For Energy Nania

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Excel Spreadsheets Templates Spreadsheet Template

Family Smoking Prevention And Tobacco Control Act Tobacco Control Tobacco Facts Infographic Health

The Practice Of Real Property Taxation In The World Springerlink