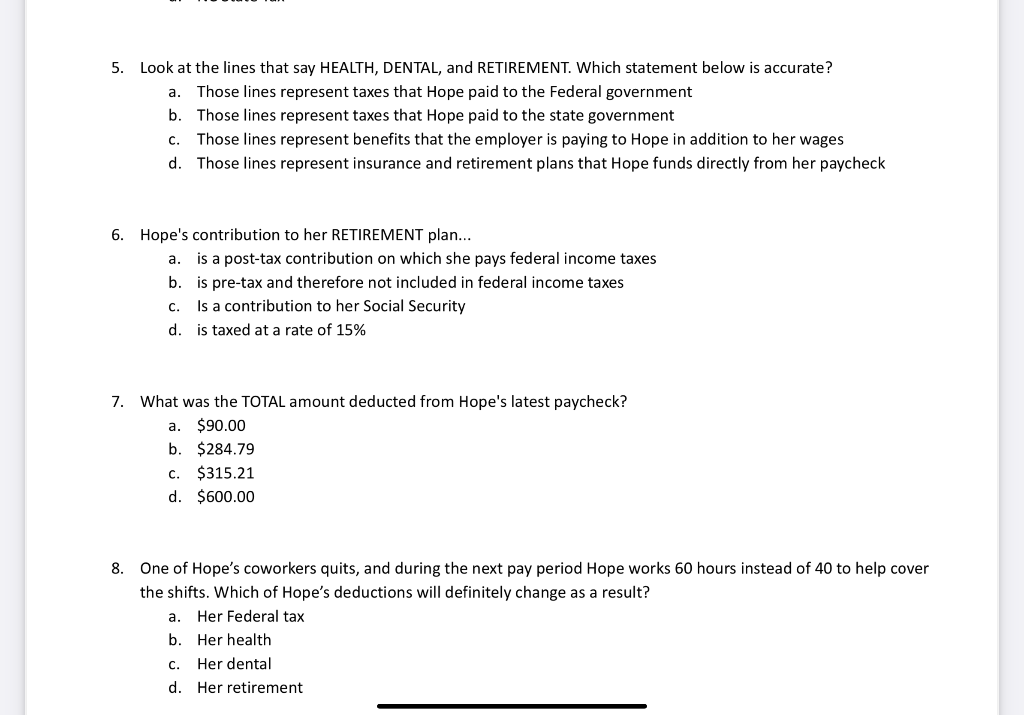

how much federal taxes deducted from paycheck nc

State Tax is the tax mentioned to the cousin in the text. See how your refund take-home pay or tax due are affected by withholding amount.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How much tax do I pay on 3200 a.

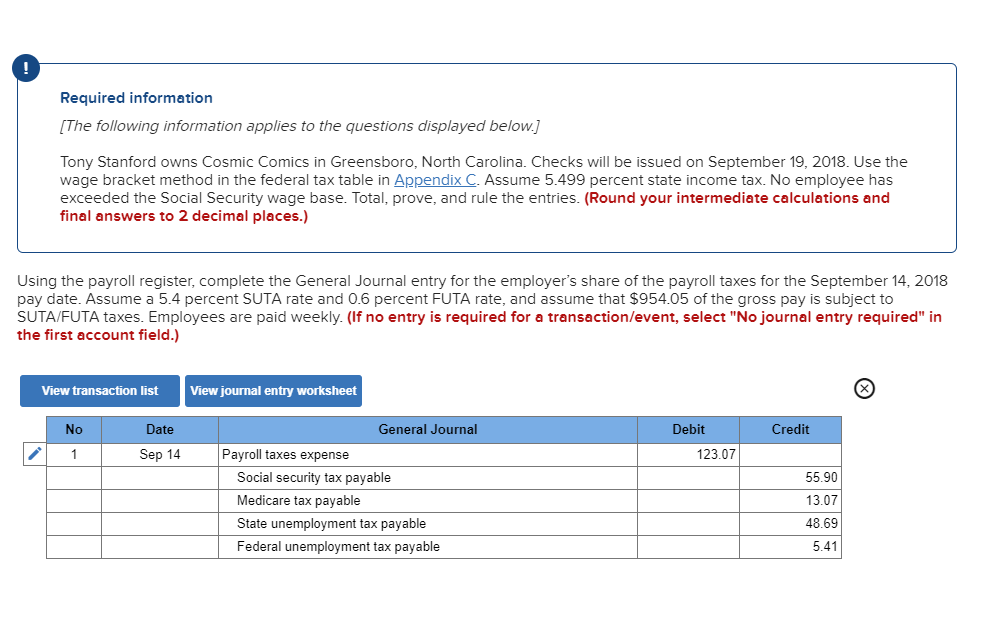

. 95-258 a 1 - The employer is required to. You can have 10 in federal taxes withheld directly from your pension and IRA. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

Mailing Address 1410 Mail Service Center Raleigh NC 27699-1410. That is a 10 rate. You fill out a pretend tax return and calculate that you will owe 5000 in taxes.

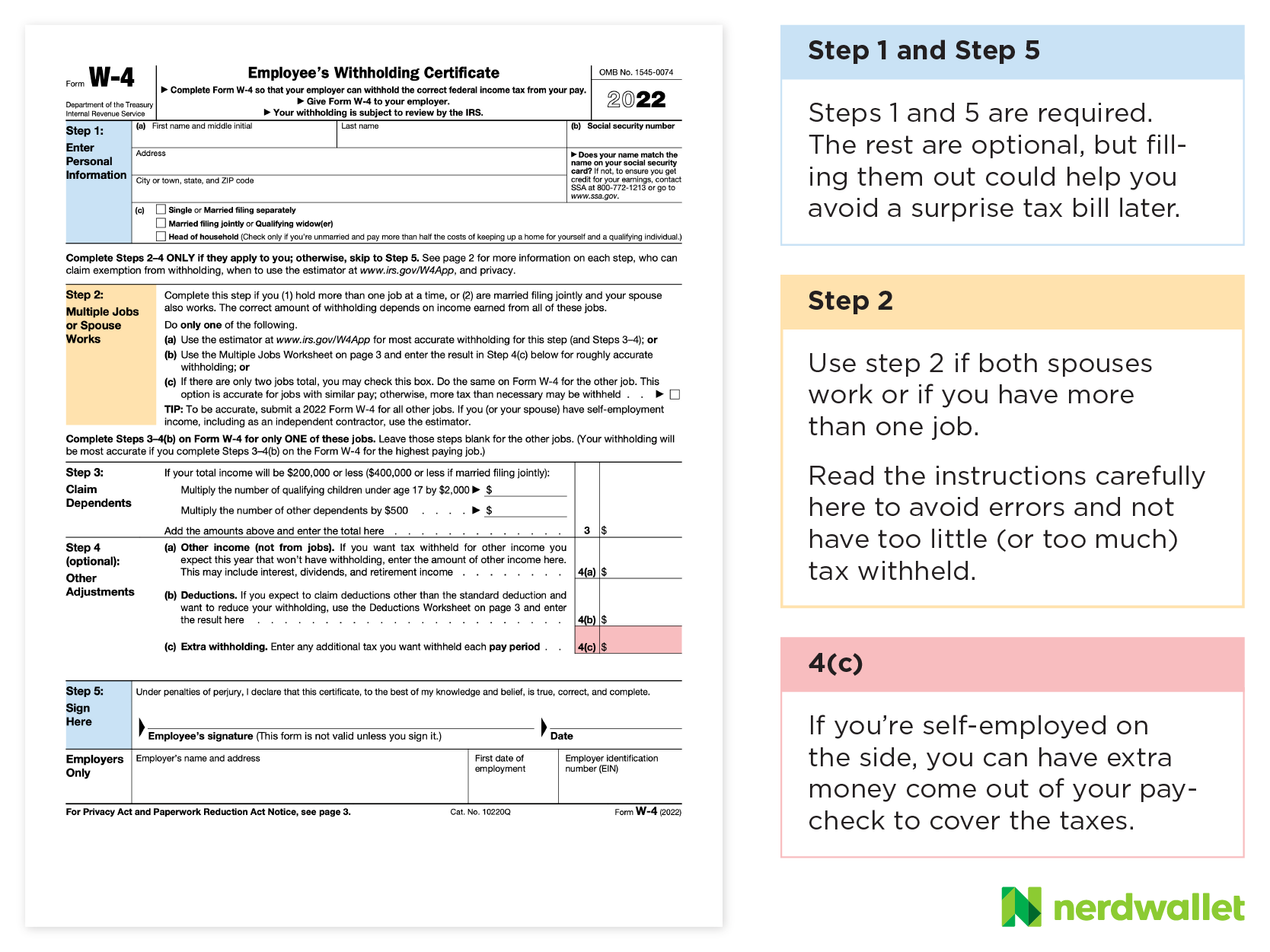

The amount of taxes to be withheld is. Standard deduction or NC. Use this tool to.

The money also grows tax-free so that you only pay income tax when you. Hourly non-exempt employees must be paid time and a. The median household income is 52752 2017.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. How Is Tax Deducted From Salary. You may deduct from federal adjusted gross income either the NC.

However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. In most cases your state income tax will be less if you take the larger of. North Carolina has not always had a flat income tax rate though.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The income tax is a flat rate of 499. Any wages above 147000 are exempt from.

The payer has to deduct an amount of tax based on the rules prescribed by the. For Tax Years 2019 2020 and 2021 the North Carolina individual income tax rate is 525 00525. For 2022 employees will pay 62 in Social Security on the.

How much tax is deducted from a paycheck in NC. How It Works. Minimum Wage in North Carolina in 2021.

It is 525 and must be paid by any resident or non-resident who generates money in the USA. No state-level payroll tax. These amounts are paid by both employees and employers.

Physical Address 3514 Bush Street Raleigh NC 27609 Map It. How to calculate Federal Tax based on your Monthly Income. FICA taxes consist of Social Security and Medicare taxes.

Estimate your federal income tax withholding. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when. In October 2020 the IRS released the tax brackets for 2021. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee.

Pay Your North Carolina Small Business Taxes Zenbusiness Inc

Tax Withholding For Pensions And Social Security Sensible Money

I Can T Take It No More Nc Workers Demand 15 Minimum Wage Wunc

North Carolina School Of Science And Mathematics Ncssm Employee Payroll Deduction Form

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com

Wage Hand Salary In Charlotte Nc Comparably

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

W 4 Form What It Is How To Fill It Out Nerdwallet

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Taxable Wage Definition For Social Security Taxes

Wage Salary Specialist Salary Salary In Charlotte Nc Comparably

State Income Tax Rates And Brackets 2021 Tax Foundation

North Carolina S Small Business Scorecard February 2019

2022 Federal Payroll Tax Rates Abacus Payroll

Solved Edit No Payroll Registers Were Provided I Chegg Com

Here S How Much You Make On 200 000 Income After Taxes In All 50 States